Managing the finances of any business is a multifaceted challenge that requires diligence, strategy, and a clear understanding of various financial practices. Small business are no different and, in fact, without significant cash reserves and credit facilities of larger companies, even more critical. By implementing the following insights, small business owners can ensure they are not only avoiding debt but also positioning their businesses for sustainable growth and success.

Key Takeaways:

- Establish clear boundaries between personal and business finances to simplify tax management and enhance financial clarity.

- Utilize reliable accounting software like Infawork and adhere to a regular accounting schedule to maintain accurate financial records.

- Implement strategies to optimize cash flow, such as mobile payment solutions and efficient billing practices, to improve revenue.

- Make strategic investments in your business’s growth and carefully consider the benefits of leasing versus purchasing equipment.

- Regularly monitor financial health through updated records and prepare for the future with solid financial planning and resilience.

- Close each month within 5 to 7 business days and make time to review the income and expenses with a clear goal of intimately understanding your company’s cashflow.

Establish a Solid Financial Foundation.

Separate Personal and Business Finances.

One of the foundational steps in managing your small business’s money is to separate your personal and business finances. This separation simplifies tax preparation, enhances liability protection, and provides a clearer financial picture for decision-making.

- Open a business bank account to handle all business-related transactions.

- Obtain a business credit card for company expenses.

- Use the accounting software Infawork to categorize and track business expenses.

Remember, the clarity that comes from this separation can be instrumental in analyzing business performance and planning for future growth.

Choose the Right Accounting Software.

The ideal software should be all-encompassing, user-friendly, cost-effective, and compatible with other systems your business utilizes. It’s essential to consider both your current needs and potential future growth when making your choice.

Using an all-in-one solution Infawork can offer several benefits for small businesses:

- Cost-Effective: Instead of paying for multiple individual software tools, an all-in-one solution provides a more cost-effective option.

- Simplicity: Managing one software platform is simpler than managing multiple tools, reducing the learning curve for employees and streamlining operations.

- Integration: All-in-one software integrates various business functions, such as CRM, accounting, project management, and marketing, allowing for seamless data sharing and improved efficiency.

- Scalability: Many all-in-one solutions are scalable, meaning they can grow with your business and accommodate increased workload and complexity.

- Consistent User Experience: With all functions in one place, users experience a consistent interface and workflow, which can improve productivity.

- Data Centralization: Centralizing data in one platform can improve data accuracy, reduce duplication, and make it easier to generate comprehensive reports and analytics.

- Support and Updates: All-in-one software providers typically offer comprehensive support and regular updates, ensuring that your business has access to the latest features and security patches.

- Customization: Many all-in-one solutions offer customization options, allowing businesses to tailor the software to their specific needs and workflows.

Many small businesses benefit from the real-time data and accessibility provided by online accounting tools. These platforms allow you to manage finances from anywhere, offering a clear view of accounts payable and receivable, which is vital for budgeting and cash flow projections.

The right software can transform your financial management, providing secure cloud storage and preventing the loss or damage of important documents.

Develop an Accounting Schedule.

Develop a routine for recording transactions as they occur to prevent discrepancies and ensure financial clarity. Infawork will streamline this process, allowing for real-time updates and access to financial data from anywhere.

- Weekly Tasks: Review and categorize transactions.

- Monthly Tasks: Reconcile bank statements and generate financial reports.

- Quarterly Tasks: Assess financial performance and plan for tax obligations.

- Yearly Tasks: Compile year-end reports and strategize for the upcoming year.

Establishing a regular accounting schedule not only keeps your financial records in order but also provides valuable insights into your business’s financial health. This proactive approach enables you to make informed decisions and adjust strategies promptly.

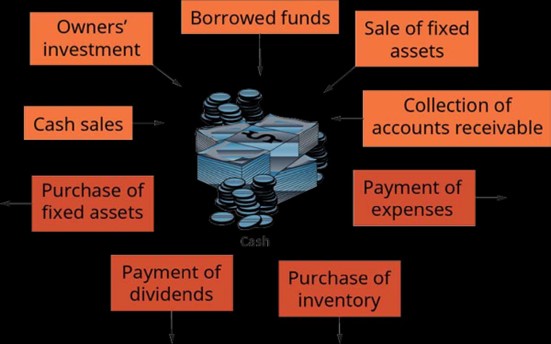

Optimize Cash Flow and Revenue.

Implement Mobile Payment Systems

Mobile payment solutions offer a seamless way for customers to pay for products and services, thereby enhancing the liquidity of your business. Systems like GoPayment allow for payments via smartphones and integrate easily with accounting software, streamlining the financial management process.

Mobile payment systems can not only expedite the transaction process but also gain real-time insights into their financial status, aiding in more informed decision-making.

Building a robust process for collecting payments is essential. Consider the following steps to ensure efficiency:

- Evaluate and select a mobile payment system that aligns with your business needs.

- Train your staff on how to use the mobile payment technology effectively.

- Integrate the payment system with your accounting software for seamless financial tracking.

- Regularly review and update the process to adapt to new technologies and customer preferences.

Strategies for Avoiding Late Fees

Late fees hurt small business cash flow. Avoid unnecessary costs by being proactive and organized.

Here are some strategies to help you stay on top of your obligations:

- Set up reminders for all bill due dates to ensure timely payments.

- Craft a detailed budget to manage your finances and anticipate upcoming expenses.

- Restructure your payments and collections to align with your cash flow.

- Negotiate extended payment terms with suppliers to defer expenses when possible.

It’s important to keep a close eye on your finances and prepare for unexpected expenses to avoid late fees and maintain a consistent cash flow. Nearly 9 out of 10 businesses face late payments, which can disrupt your financial planning. Implementing these strategies can help you avoid being part of this statistic and keep your business moving forward without the burden of additional fees.

Effective Billing and Collection Techniques

Establish a standard billing schedule for all projects. This not only simplifies account management but also ensures consistent monthly revenue tracking. When creating contracts, it’s essential to specify payment terms, including amounts and due dates, and to define penalties for late payments.

Building a billing strategy is vital for small business financial management. It directly impacts cash flow management and client payment behaviors. If current billing methods are ineffective in securing timely payments, consider revising your invoicing approach.

Implementing proper B2B collection strategies can not only improve cash flow but also strengthen customer relationships. A proactive approach to collections, including prompt and assertive follow-up on overdue accounts, is necessary. Regular reminders to accounts receivable about their obligations can prevent losses from uncollected invoices.

Key Billing and Collection Steps

| Step | Action |

| 1 | Define clear payment terms in contracts |

| 2 | Establish a standard billing schedule |

| 3 | Include penalties for late payments |

| 4 | Outline change order approval process |

| 5 | Ensure invoices are detailed and include proof-of-work |

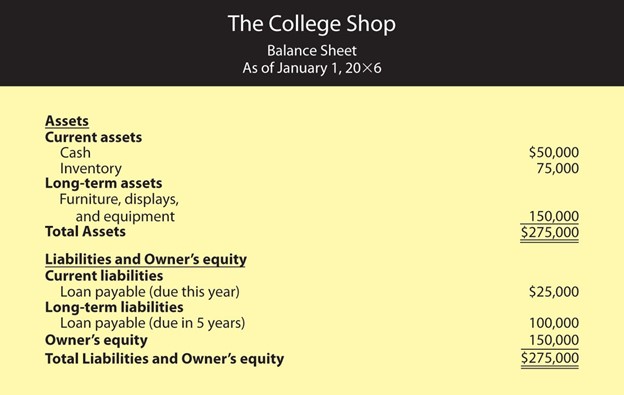

Strategic Spending and Investment

Balance Expenditure with Return on Investment

To ensure financial stability and growth, small businesses must balance their expenditures with the potential return on investment (ROI). This involves a careful analysis of where funds are allocated and how those investments perform over time.

- Begin by conducting a cash flow analysis to review earnings and spending, identifying areas where adjustments may be necessary.

- Implement a system for tracking the performance of investments, allowing for agile budget reallocation based on results.

- Consider the cost-benefit of potential tax incentives and how they align with your investment strategy.

Maintain a reserve for unforeseen circumstances while managing growth and working capital. This balance is key to sustaining business operations and facilitating expansion.

Benchmarking against similar businesses can provide valuable insights into effective spending habits. However, it’s essential to tailor your budget to your business’s unique financial situation and available cash.

Invest in Business Growth

Investing in the growth of your small business is crucial for long-term success. Equity investments and debt financing are two primary methods to fund this expansion. Equity investments involve selling a portion of your business to investors, while debt financing means borrowing money that you will need to repay over time.

- Equity Investments: Selling shares to venture funders or angel investors.

- Debt Financing: Securing loans to fund growth without diluting ownership.

It’s essential to assess the potential return on investment (ROI) for any growth strategy. This includes considering the costs of expansion against the projected increase in revenue. A well-planned growth strategy should aim for profitability, not just increased sales. Consulting with financial professionals can guide you toward a plan that balances growth with profit margins.

Strategic investment in business growth requires a careful balance of risk and opportunity. Ensuring you have reserves for both opportunities and unforeseen market fluctuations is key to sustainable expansion.

The Role of Leasing and Renting Equipment

Leasing or renting equipment can be a strategic move for small businesses, especially when starting up or during periods of growth. By choosing to lease, businesses can conserve cash flow and avoid the large upfront costs associated with purchasing new equipment. This approach not only allows for the use of the latest technology but also offers flexibility to upgrade as needs evolve.

When considering the lease option, it’s important to understand the financial implications. Leases often come with tax benefits, such as potential tax credits, which can reduce the overall tax burden. Moreover, leasing can prevent the hassle of selling or upgrading outdated equipment, as the responsibility for maintenance typically remains with the lessor.

Strategic leasing aligns with both short-term financial management and long-term planning. It enables businesses to respond quickly to market changes without the weight of owning depreciating assets.

Missing payments can lead to the lessor reclaiming the equipment, which can disrupt business operations. Careful consideration of the lease terms and a solid repayment plan are essential to ensure that leasing remains a beneficial strategy for your business.

Maintain Financial Health

Monitor and Updating Financial Records

Keeping your financial records up-to-date is crucial for understanding the health of your business. Regular analysis of your accounting and bookkeeping is essential, not just for compliance, but also for gaining insights into your business’s financial trends. This practice allows you to become intimately familiar with your business finances, enabling informed decision-making.

It is vital to record expenses as they occur to maintain accurate financial management. Missed or unrecorded items can quickly lead to discrepancies that affect your overall financial picture.

Creating an accounting timetable can streamline this process. Utilize accounting software to set reminders for reviewing financial tasks that have not been completed within a specific period. Here’s a simple weekly checklist to ensure consistency:

- Monday: Reconcile transactions from the previous week.

- Wednesday: Review and categorize expenses.

- Friday: Analyze cash flow and prepare financial statements.

Monthly reconciliation and proper categorization of expenses are non-negotiable practices to ensure accuracy. Consult with your CPA regularly, especially when significant financial events occur, to keep your records precise and useful for strategic planning.

Understand the Importance of Good Business Credit

Good business credit is a cornerstone of a company’s financial health. It not only influences the ability to obtain financing but also affects the terms of credit offered by lenders and suppliers. Maintaining a strong business credit score can lead to better interest rates, higher lines of credit, and more favorable payment terms.

To build and sustain good business credit, it’s essential to establish credit accounts with suppliers and lenders and ensure that all payments are made on time. This demonstrates to creditors that your business is reliable and creditworthy. Additionally, regularly monitoring your credit report for inaccuracies can help you maintain a clean financial reputation.

Building solid business credit is not an overnight task. It requires consistent effort and financial discipline. By making strategic decisions and managing your finances prudently, you can create a robust credit profile that will support your business’s growth and stability.

Remember, your business credit is a reflection of your company’s financial responsibility. It’s a critical factor that lenders and suppliers consider when evaluating your business for credit or loans. Therefore, investing time and resources to improve your business credit can yield significant long-term benefits.

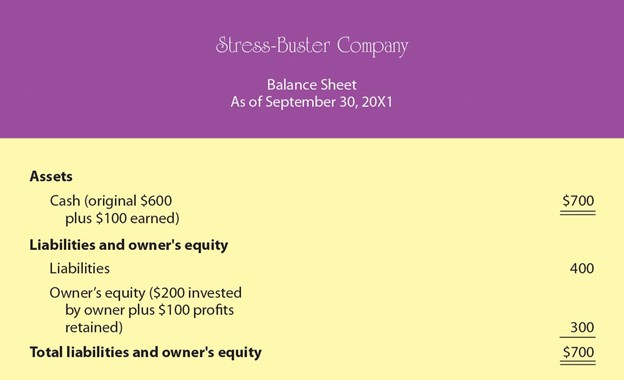

Prepare Accurate Cash Flow Statements

If you want to keep track of your business’s financial health, we suggest having accurate cash flow statements. They provide a snapshot of the cash entering and leaving your business, allowing you to make informed decisions. Regularly updating your cash flow projection is key to maintaining accuracy, as it reflects the latest information on expenses and profits. Comparing budgeted cash flows to actual figures can help you anticipate future cash positions.

To enhance the precision of your cash flow statements, consider the following formulas:

- Net income + Depreciation / Amortization – Change in working capital – Capital expenditure = Free cash flow

- Depreciation + Operating income – Taxes + Change in working capital = Operating cash flow

- Beginning cash + Projected inflows – Projected outflows = Ending cash = Cash flow forecast

Diligently tracking individual transactions can ensure that your cash flow statement captures the exact timing of sales completions and debt acquisitions. This level of detail is essential for maintaining an accurate depiction of your business’s credit and ensuring sufficient liquidity for operational needs.

Plan for the Future

Set Up Financial Goals and Milestones

Setting financial goals is a very important step in ensuring the long-term success of your small business. Outline clear objectives and plan for the future by considering both your current resources and your aspirations. Start by creating a budget that reflects your financial targets, including any known one-time expenses and savings for the upcoming year.

To maintain a realistic perspective, implement a three-step debt strategy that allows you to manage liabilities while pursuing growth. Aim high, but with grounded expectations, focusing on your business’s strengths to drive success.

A solid financial plan is not just about setting goals—it’s about creating a dynamic roadmap that adapts to changes in your business landscape.

Regularly review your financial performance, such as gross and net margin percentages, to ensure they align with your objectives. Use tools like accounting software for real-time monitoring and to compare estimated income and expenses with actual figures. This approach provides a clear guide through your financial year and helps you stay on course.

The Smart Approach to Business Loans

Having a strategic mindset when approaching business loans is important for small business owners. Ensure you have the capacity to repay the loan under various circumstances, including periods when profits may not be optimal. It’s not just about having access to funds; it’s about smart financial management and planning for repayment without jeopardizing your business’s stability.

When considering a loan, assess your business’s financial health and borrowing capacity. A loan should be a tool for growth, not a means to an end that leads to financial strain.

Here are some key considerations for a smart approach to business loans:

- Evaluate the purpose of the loan and how it aligns with your business goals.

- Understand the terms and conditions of the loan, including interest rates and repayment schedules.

- Consider alternative financing options, such as business lines of credit, which can offer more flexibility.

The best time to secure a loan is when your business is financially stable. This not only increases the likelihood of approval but also provides a safety net for future uncertainties.

Build Financial Resilience and Stability

Building financial resilience and stability is a critical aspect of managing a small business. Having a resilient cash reserve is akin to creating a safety net that can protect your business during economic downturns or unexpected expenses. It’s recommended to maintain a cash reserve equivalent to at least 25% of annual expenses to ensure you can continue operations and serve clients without disruption.

Proactive financial planning and mastery of cash flow management are the cornerstones of long-term business resilience. By preparing for emergencies and adopting a forward-thinking mindset, you can safeguard your business against market fluctuations and unforeseen events.

To further enhance financial stability, consider the following steps:

- Regularly review and adjust your budget to align with current financial realities.

- Implement robust budget planning to prepare for and mitigate emergencies.

Focus on continuous improvement of cash flow management techniques.

By taking these measures, you position your small business for sustained growth and success, ensuring it thrives and meets its long-term goals.

Conclusion

In conclusion, effectively managing your small business’s finances is a multifaceted endeavor that requires diligence, strategic planning, and a clear understanding of your financial landscape. By separating personal and business finances, utilizing the right tools and software, and maintaining a disciplined approach to cash flow management, you can ensure the financial health and longevity of your business. Remember to pay yourself as a valuable member of your business, invest in growth, and don’t shy away from loans when necessary. With these practices in place, you’ll be well-equipped to navigate the challenges of small business financial management and steer your company toward a prosperous future.

Frequently Asked Questions

How do small business owners manage their finances?

Small business owners can manage their finances by separating business and personal finances, using the right accounting software, creating an accounting schedule, speeding up cash flow with mobile payment systems, leasing or renting equipment, avoiding late fees, paying themselves, maintaining good business credit, investing in business growth, not fearing loans, having a sound billing strategy, and monitoring their books with a focus on both expenditure and ROI.

Why is it important to separate personal and business finances?

Separating personal and business finances helps in simplifying tax preparation, providing a clear view of business cash flow, and avoiding intermingling of funds which can lead to financial mismanagement and legal complications.

What strategies can help avoid late fees in small businesses?

To avoid late fees, small businesses should implement efficient billing and collection techniques, maintain an organized accounting schedule, use automated reminders for due payments, and negotiate favorable payment terms with suppliers.

How can investing in business growth benefit a small business?

Investing in business growth can lead to increased revenue, improved market position, and the development of new products or services. It helps the business to adapt to market changes, attract new customers, and retain existing ones.

What is the role of good business credit for a small business?

Good business credit is crucial for securing loans at favorable interest rates, establishing trust with suppliers, and ensuring the business can capitalize on opportunities for growth. It reflects the financial health and reliability of the business.

Why is it important for small business owners to pay themselves?

Paying themselves ensures that business owners receive compensation for their work, helps in personal financial stability, and can motivate them to continue working hard. It also sets a precedent for managing the business’s finances responsibly.